How can tax cuts help revive the economy Essay Example | Topics and Well Written Essays - 500 words. https://studentshare.org/macro-microeconomics/1753305-how-can-tax-cuts-help-revive-the-economy

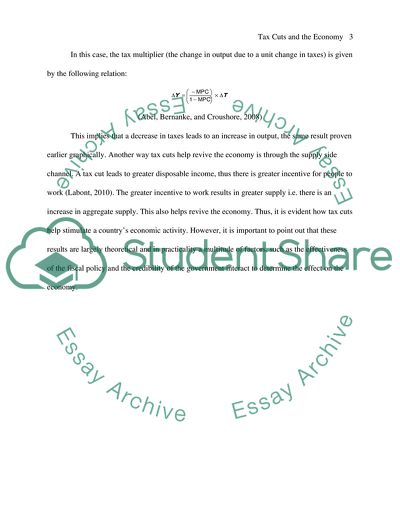

How Can Tax Cuts Help Revive the Economy Essay Example | Topics and Well Written Essays - 500 Words. https://studentshare.org/macro-microeconomics/1753305-how-can-tax-cuts-help-revive-the-economy.